Unlocking The Potential Of Tesla Investment Platform

Tesla Investment Platform has emerged as a beacon for investors seeking innovative opportunities in the ever-evolving landscape of electric vehicles and sustainable energy solutions. As Tesla continues to make headlines with its groundbreaking advancements, the investment platform associated with the company offers unique prospects for both seasoned investors and newcomers. By leveraging the expertise and vision of Tesla's leadership, the platform provides an avenue to tap into the future of technology and energy.

In recent years, Tesla has not only redefined the automotive industry but also expanded its reach into various sectors, including energy storage and solar power. This diversification has opened up new investment channels, making the Tesla Investment Platform a focal point for those looking to capitalize on the company's growth trajectory. Investors are now presented with a myriad of options to participate in Tesla's success, from direct stock purchases to innovative financial products designed to maximize returns.

Understanding the nuances of the Tesla Investment Platform is crucial for anyone interested in navigating the complexities of modern-day investing. With a focus on sustainability, technological innovation, and market leadership, the platform represents a compelling opportunity to align financial goals with a vision for a greener, more efficient future. This article delves into the intricacies of the Tesla Investment Platform, exploring its features, potential benefits, and the strategic foresight required to make informed investment decisions.

Table of Contents

- What is Tesla Investment Platform?

- How does Tesla Investment Platform work?

- Why invest in Tesla?

- The Role of Elon Musk in Tesla Investment Platform

- Strategies for Success on Tesla Investment Platform

- What are the risks associated with Tesla Investment Platform?

- How to start investing in Tesla?

- Exploring Tesla Stock Options

- The Impact of Tesla’s Innovation on Investments

- Tesla’s Sustainability Initiatives and Investment Potential

- How does Tesla Investment Platform benefit retail investors?

- What experts say about Tesla Investment Platform?

- Case Studies of Successful Tesla Investments

- Future Prospects for Tesla Investment Platform

- Final Thoughts on Tesla Investment Platform

What is Tesla Investment Platform?

The Tesla Investment Platform serves as a gateway for individuals and institutions aiming to invest in one of the most dynamic companies in the world. Tesla, renowned for its electric vehicles and sustainable energy solutions, provides a structured platform for investors to engage with its stock and related financial products. This platform encompasses a variety of investment options, including direct stock purchases, derivatives, and specialized funds tailored to Tesla's market performance.

How does Tesla Investment Platform work?

The mechanics of the Tesla Investment Platform are designed to facilitate seamless investment experiences for both beginners and seasoned investors. By providing access to Tesla's stock, the platform allows investors to buy, hold, or sell shares based on market conditions and personal financial goals. Additionally, the platform offers educational resources and analytical tools to help investors make informed decisions, ensuring that they are well-equipped to navigate the volatile nature of the stock market.

Why invest in Tesla?

Investing in Tesla presents a unique opportunity to be part of a transformative journey in the automotive and energy sectors. Tesla's commitment to innovation, sustainable practices, and technological advancements has positioned it as a leader in its field. Investors are drawn to Tesla not only for its potential financial returns but also for the chance to support a company that is reshaping industries and pushing the boundaries of what's possible. Here are some key reasons to consider investing in Tesla:

- Strong market presence and brand recognition

- Proven track record of growth and innovation

- Commitment to sustainability and environmental responsibility

- Leadership under visionary CEO, Elon Musk

The Role of Elon Musk in Tesla Investment Platform

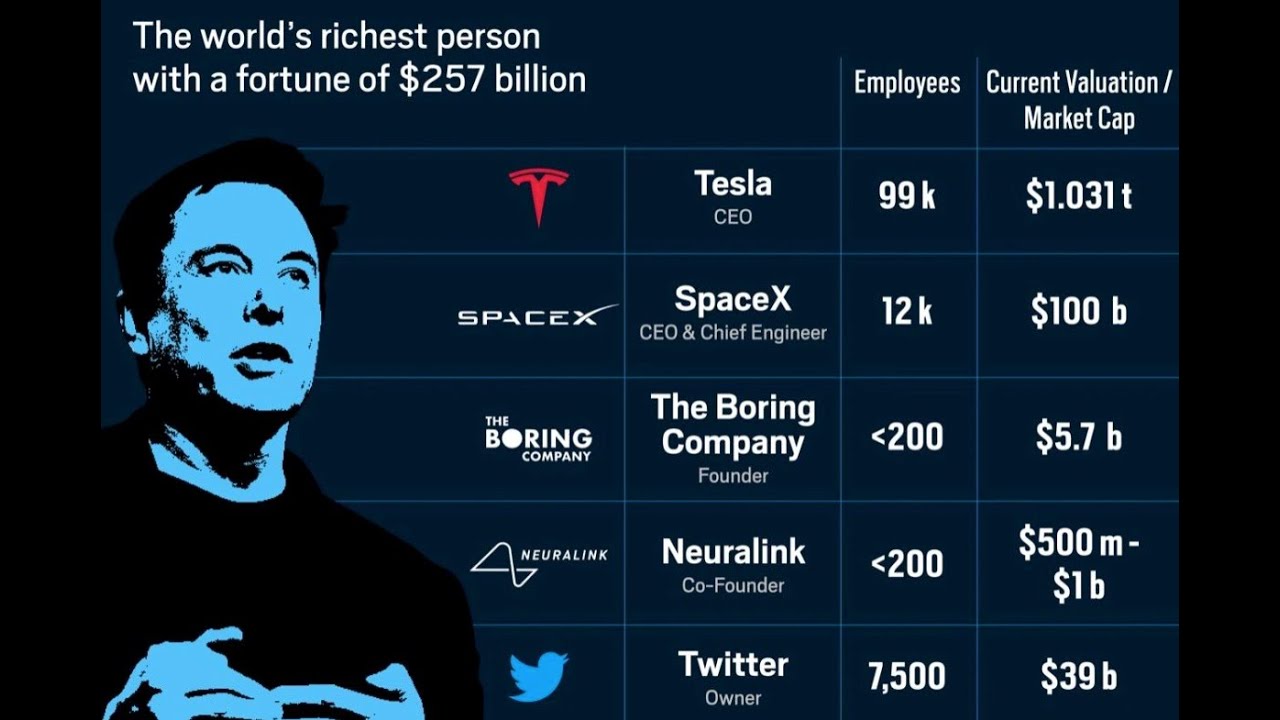

Elon Musk, the charismatic CEO of Tesla, plays a pivotal role in the success and appeal of the Tesla Investment Platform. His vision for the future of transportation and energy has been a driving force behind Tesla's growth and innovation. Musk's leadership style, characterized by bold decision-making and a relentless pursuit of excellence, has instilled confidence in investors and contributed to Tesla's reputation as a forward-thinking company.

Strategies for Success on Tesla Investment Platform

To maximize the potential of the Tesla Investment Platform, investors should consider adopting strategic approaches tailored to their financial goals and risk tolerance. Some effective strategies include:

- Diversifying investments to mitigate risks

- Staying informed about Tesla's market trends and innovations

- Setting realistic financial goals and timelines

- Utilizing analytical tools and resources provided by the platform

What are the risks associated with Tesla Investment Platform?

While the Tesla Investment Platform offers exciting opportunities, it also comes with inherent risks that investors should be aware of. The stock market is inherently volatile, and Tesla's stock can experience significant fluctuations due to various factors, including market conditions, industry competition, and regulatory changes. Investors should be prepared for potential losses and consider their risk tolerance before committing funds.

How to start investing in Tesla?

Starting your investment journey with the Tesla Investment Platform involves a few crucial steps. First, potential investors should conduct thorough research to understand Tesla's market position and future prospects. Next, they should set up an investment account with a reputable brokerage that offers access to Tesla's stock. Finally, investors can begin purchasing shares, monitoring their performance, and making adjustments as needed to align with their financial objectives.

Exploring Tesla Stock Options

The Tesla Investment Platform offers a range of stock options for investors to consider. These options include traditional stock purchases, where investors buy and hold Tesla shares, as well as more complex financial products such as options and derivatives. Each option comes with its own set of advantages and risks, and investors should carefully evaluate their financial goals and risk tolerance before making a decision.

The Impact of Tesla’s Innovation on Investments

Tesla's relentless pursuit of innovation has had a profound impact on its stock performance and the broader investment landscape. The company's groundbreaking advancements in electric vehicles, battery technology, and sustainable energy solutions have not only propelled its growth but also attracted investors eager to capitalize on its success. Tesla's commitment to pushing the boundaries of what's possible continues to drive interest in the Tesla Investment Platform.

Tesla’s Sustainability Initiatives and Investment Potential

As a leader in sustainable technology, Tesla's initiatives in clean energy and environmental responsibility have made it an attractive option for socially conscious investors. The company's commitment to reducing carbon emissions and promoting renewable energy solutions aligns with the values of many investors seeking to make a positive impact through their financial choices. The Tesla Investment Platform provides an opportunity to support these initiatives while potentially reaping financial rewards.

How does Tesla Investment Platform benefit retail investors?

The Tesla Investment Platform offers several benefits to retail investors, making it an appealing choice for those looking to diversify their portfolios. Key advantages include:

- Access to a high-growth company with a strong market presence

- Opportunities to invest in innovative technology and sustainability initiatives

- Educational resources and tools to support informed investment decisions

- Potential for significant financial returns

What experts say about Tesla Investment Platform?

Industry experts and financial analysts have shared varying perspectives on the Tesla Investment Platform. While some praise Tesla's innovative approach and market leadership, others caution about the volatility and risks associated with investing in a high-growth company. Overall, experts agree that Tesla offers unique opportunities for investors willing to embrace the potential rewards and challenges of investing in a rapidly evolving industry.

Case Studies of Successful Tesla Investments

Numerous investors have experienced success with the Tesla Investment Platform, capitalizing on the company's impressive growth and market presence. Case studies of successful Tesla investments highlight the importance of strategic decision-making, timing, and a willingness to adapt to changing market conditions. These stories serve as valuable lessons for investors seeking to maximize their returns while navigating the complexities of the stock market.

Future Prospects for Tesla Investment Platform

The future of the Tesla Investment Platform appears promising, with the company poised to continue its trajectory of growth and innovation. As Tesla expands its reach into new markets and technologies, the platform is likely to offer even more opportunities for investors to participate in its success. However, potential investors should remain vigilant and informed, as the dynamic nature of the industry presents both opportunities and challenges.

Final Thoughts on Tesla Investment Platform

The Tesla Investment Platform stands out as a compelling option for investors seeking to align their financial goals with a vision for a sustainable future. While the platform offers exciting opportunities, it also demands careful consideration and strategic planning to navigate the risks and uncertainties of the stock market. By leveraging the insights and resources available through the platform, investors can make informed decisions and potentially reap the rewards of Tesla's ongoing success.

Article Recommendations

- Understanding The Lives Of Hank Williams Jrs Children A Deep Dive

- Andre Rieus Life Partner A Closer Look At Love And Harmony

- Ronnie Coleman Where Is He Now The Legends Latest News